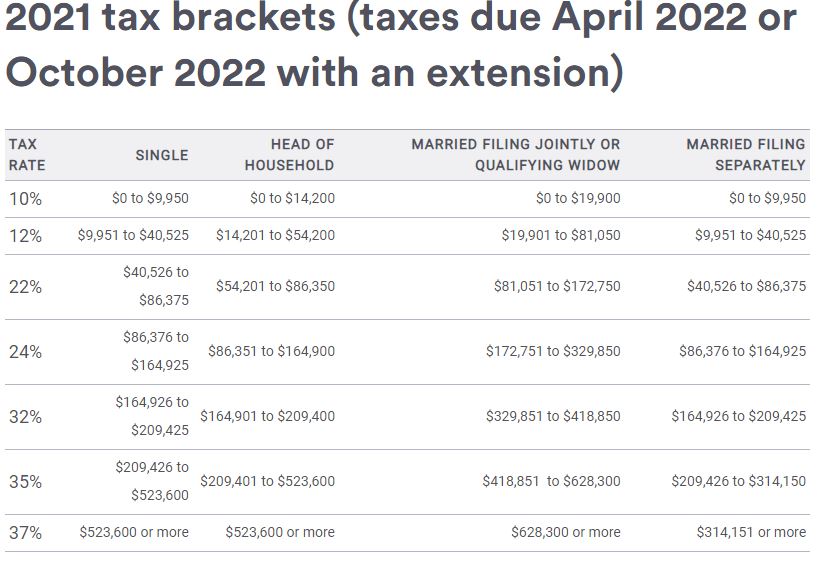

Tax brackets are how the IRS determines which income levels get taxed at which federal income tax rates. The higher the income you report on your tax return, the higher your tax rate.

There are seven tax brackets for most ordinary income for the 2021 tax year.

10%, 12%, 22%, 24%, 32%, 35% and 37%.

Your tax bracket depends on your taxable income and your filing status. Filing statuses include single, married filing jointly or qualifying widow(er), married filing separately and head of household. Generally, as you move up the pay scale, you also move up the tax scale.

The IRS on Nov. 10 2022 announced new tax brackets for the 2022 tax year. There are seven tax brackets for most ordinary income for the 2022 tax year.

10%, 12%, 22%, 24%, 32%, 35% and 37%.

How federal tax brackets work

Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to know their effective tax rate.

Instead of looking at what tax bracket you fall in based on your income, determine how many individual tax brackets you overlap based on your gross income.

Figuring that out is easier in practice:

- Example one: Say you’re a single individual who earned $40,000 of taxable income in the 2021 tax year. Technically, you’d be aligned in the 12% tax bracket, but your income wouldn’t be levied a 12% rate across the board. Instead, you would follow the tax bracket up on the scale, paying 10% on the first $9,950 of your income and then 12% on the next chunk of your income between $9,951 and $40,525. Because you don’t make above $40,525, none of your income would be hit at the 22% rate.

That often amounts into Americans being charged a rate that’s smaller than their individual federal income tax bracket, known as their effective tax rate.

- Example two: Say you’re a single individual in 2021 who earned $70,000 of taxable income. You would pay 10% on the first $9,950 of your earnings ($995); then 12% on the chunk of earnings from $9,951 to $40,525 ($3,669), then 22% on the remaining income ($6,484.50)

- Your total tax bill would be $11,148.50. Divide that by your earnings of $70,000 and you get an effective tax rate of roughly 16%, which is lower than the 22% bracket you’re in.

The brackets above show the tax rates for 2021 and 2022. The brackets are adjusted each year for inflation.

What is a Marginal Tax Rate?

Another way of describing the U.S. tax system is by saying that most Americans are charged a marginal tax rate. That’s because as income rises, it is taxed at a higher rate. In other words, the last dollar that an American earns is taxed more than the first dollar. This is what’s known as a progressive tax system.

The technical definition of a marginal tax rate would be the rate that each individual taxpayer pays on their additional dollars of income.

Let’s not forget about Capital Gains

The tax rate on short-term capitals gains is the same as the rate you pay on wages and other “ordinary” income. Those rates currently range from 10% to 37%, depending on your taxable income.

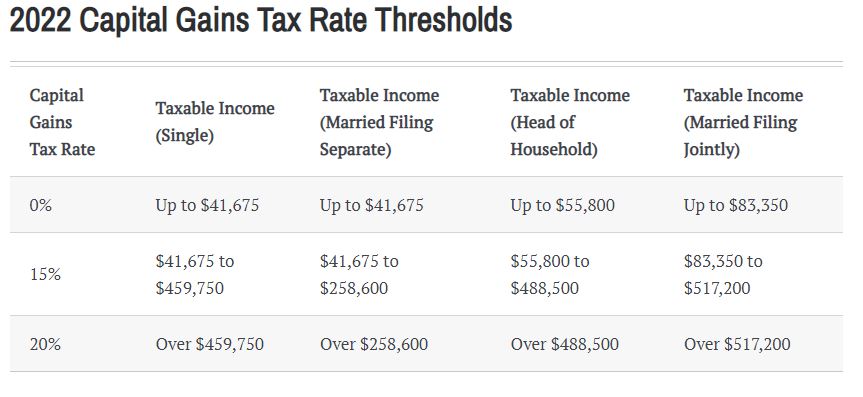

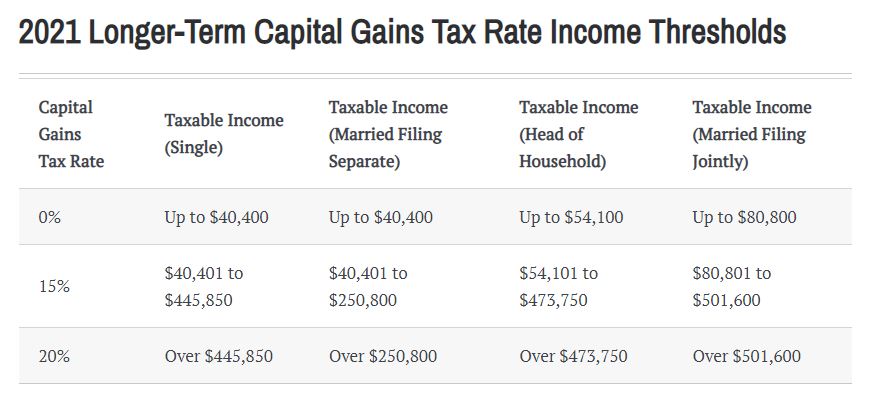

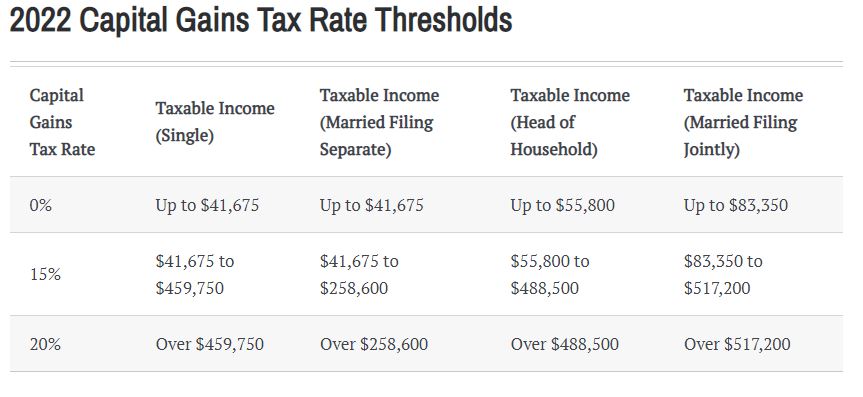

The federal income tax rate that applies to gains from the sale of stocks, mutual funds or other capital assets depends on how long you held the asset and your taxable income. Gains from the sale of capital assets that you held for at least one year and one day, which are considered long-term capital gains, are taxed at either a 0%, 15% or 20% rate.

However, which one of those long-term capital gains rates – 0%, 15% or 20% – applies to you depends on your taxable income. The higher your income, the higher the rate. Here are the capital gains taxable income thresholds for the 2021 tax year:

The income thresholds for the capital gains tax rates are adjusted each year for inflation. To see how the thresholds will change from 2021 to 2022, here are the figures for the 2022 tax year:

Surtax on Net Investment Income

There’s an additional 3.8% surtax on net investment income (NII) that you might have to pay on top of the capital gains tax. (NII includes, among other things, taxable interest, dividends, gains, passive rents, annuities, and royalties.) You must pay the surtax if you’re a single or head-of-household taxpayer with modified adjusted gross income (AGI) over $200,000, a married couple filing a joint return with modified AGI over $250,000, or a married person filing a separate return with modified AGI over $125,000. Use Form 8960 to calculate the surtax.

There are certain bills being considered that would modify the sources of income that would be subject to this NIIT but they have not had success passing through the Senate at this time. There is also much speculation that the tax rates may also be changing soon. The information included in this blog is using the current information available at the time.

This year’s tax season will begin Monday, Jan. 24, 2022, when the IRS starts accepting taxpayers’ returns. Most Americans have until April 18 to file, though they can request a six-month extension to Oct. 17.

Questions? Schedule an appointment with one of our tax professionals in person or virtually

https://westridgeaccounting.acuityscheduling.com/

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors prior to acting on any of the information provided here.