Are you searching online for “Individual Tax Preparation Services Greeley?” West Ridge Accounting & Bookkeeping specializes in individual tax preparation services.

Whether you choose our tax preparation services or another company’s, we want to share some tips to help you find a reputable tax preparer.

Individual Tax Preparation Services Greeley

- A legitimate, reputable tax preparer has an IRS-required Preparer Tax Number (PTIN) required as well as belongs to a professional organization and attends continuing education classes. Your preparer or someone in his/her office should also have authorization to represent you before the IRS, such as an enrolled agent (specifically trained in federal tax planning, preparation and representation), attorney or certified public accountants (CPA).

- Start your search by asking for referrals from family, friends and neighbors, then do your own background check on the preparer for any questionable history, disciplinary actions and status of licenses, starting with the Better Business Bureau. You can check with the IRS Office of Enrollment for enrolled agents or the Colorado Bar Association for attorneys. The web also offers a variety of review sites to get a better picture of the tax preparer’s reputation. (You can check our reviews on our Facebook page and on Google.) Avoid preparers who base their fees on your refund, say they can get you a bigger refund than others, offer to deposit your refund in their account (it should only go in your account) or ask you to sign a blank tax form. If the IRS has audited a high number of the preparer’s clients, look for another preparer.

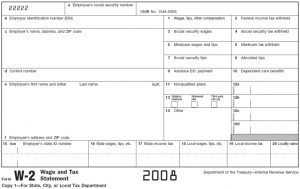

- Your preparer should ask you to provide records and receipts as well as ask questions to determine your total income, deductions, tax credits and other items. If the preparer is willing to e-file your return using your last pay stub instead of your Form W-2, find another prepare: filing without a W-2 is against IRS e-file rules.

- Confirm your preparer can e-file your return, as the IRS asks all paid preparers who prepare and file more than 10 returns for clients to do so electronically.

- Don’t sign your return until the preparer has addressed all of your concerns. The tax preparer should sign the return, including his/her PTIN, and provide you with a copy of it. Make sure the tax preparer is available after you file your return – even after the April 18 deadline – in case any questions about your return arise.

We hope your search for “Individual Tax Preparation Services Greeley” includes – and ends with – West Ridge Accounting Services. Call (970) 515-5267 or click here to book an appointment now: http://westridgeaccounting.com/book-now/