Once you have your taxes prepared, what next? The IRS generally has three years after the tax-filing deadline to initiate an audit, so you should keep your returns and supporting documents at least 3 years but some states may have a longer look back period. I always recommend 5-7 years to clients. You can upload these onto a PDF thumb drive and keep them paperless. Keeping excessive paperwork can be overwhelming and messy. Here is a general idea of things you need to keep in case of a future audit.

What Tax Information Should You Keep?

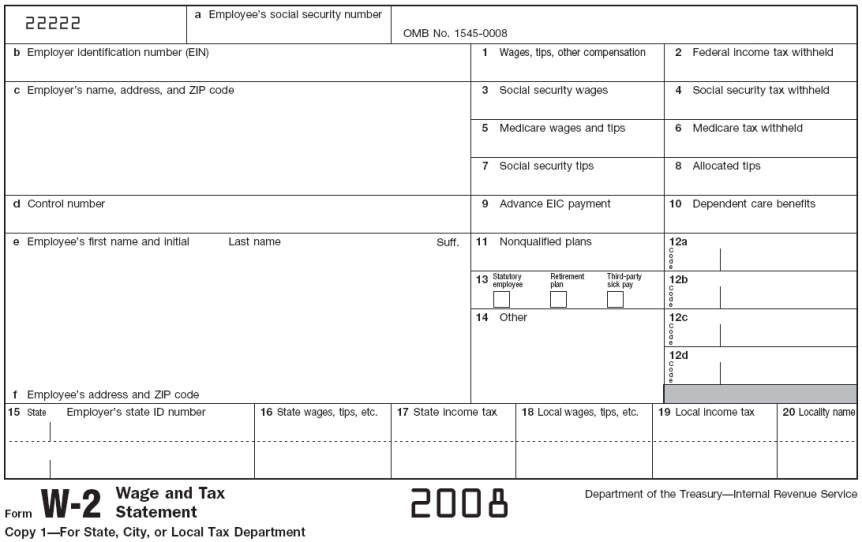

- Keep all records that show your income, such as W-2 forms; 1099 forms reporting interest, dividends, capital-gains distributions and other income

- Keep form 1098, if you deducted mortgage interest; canceled checks and receipts for charitable contributions; and records showing expenses for other deductions and credits.

- Keep records of any credits claimed; daycare, homeowners energy credits etc.

- Keep records showing eligible expenses for withdrawals from health savings accounts or 529 college-savings plans.

- Keep records of any business expenses, such as equipment purchases, phone bills, business travel and marketing expenses, if you took a home-office deduction, keep records of your rent or mortgage interest, homeowners or renters insurance, real estate taxes, utilities, and other eligible expenses.

- Keep receipts or checks showing any tax-deductible retirement-savings contributions, such as to a deductible IRA, Simplified Employee Pension or solo 401(k).

- Keep Form 1095 showing that you had eligible health insurance coverage, or records showing that you met the criteria for an exemption.