Medical Expenses Deduction for Individuals

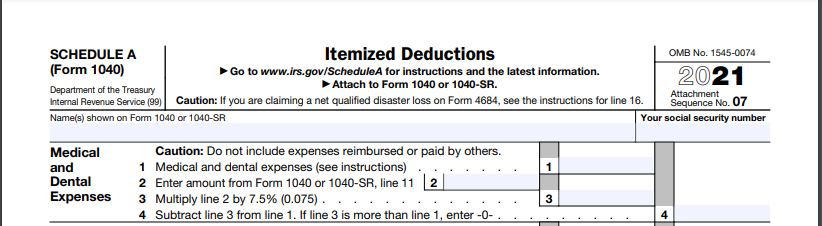

Individuals with big medical expenses got a tax win in late 2020. Taxpayers who itemize on Schedule A can continue to deduct qualifying medical expenses to the extent that the total amount exceeds 7.5% of adjusted gross income. The AGI threshold was scheduled to climb to 10% beginning in 2021, but instead, Congress permanently kept the 7.5% threshold.

You can claim medical expenses that are not reimbursed by insurance for yourself, a spouse and your dependents. For you to qualify to take medical expense deduction, the expense must be incurred primarily to alleviate or prevent a physical or mental disability or illness.

What medical expenses can you deduct?

The broad list of eligible expenses includes out-of-pocket payments for medical services rendered by doctors, dentists, optometrists and other medical practitioners; mental health services; health insurance premiums (including Medicare Parts B and D); annual physicals; prescription drugs and insulin (but not over-the-counter drugs); hearing aids; and transportation to and from the doctor’s office. But cosmetic surgery to improve your general appearance, hair transplants and teeth whitening are not eligible. For more information, about what qualifies, see IRS Publication 502.

List of common medical expenses

- Acupuncture

- Addiction treatment, including meals and lodging at a drug or alcohol addiction treatment center.

- Birth control pills prescribed by a doctor

- Braille books and periodicals used by a person who is visually impaired

- Breast pumps and pumping supplies

- Breast reconstruction surgery following a mastectomy for cancer

- Chiropractic services for medical care

- Contact lenses

- Cosmetic surgery, if necessary to improve a deformity related to a congenital abnormality, accident or disease

- Dental treatment for the prevention and alleviation of dental disease

- Diagnostic devices, such as blood sugar test kits

- Diet food, when prescribed by a doctor to alleviate a specific medical condition

- Doctor or physician expenses

- Exercise programs, when recommended by a doctor to treat a specific medical condition

- Eye exams

- Eye surgery, such as LASIK or a similar procedure

- Eyeglasses

- False teeth

- Fertility treatments, including in vitro fertilization, surgery and temporary storage of eggs or sperm

- Gender-affirming care such as hormone therapy and surgery for transgender individuals

- Guide dog or another service animal for a person with low vision or hearing

- Health, dental and vision insurance premiums

- Hearing aids

- Home improvements if their main purpose is medical care

- Hospital services while receiving medical care

- Household help for nursing care services

- Laboratory fees

- Lead-based paint removal when a child is diagnosed with lead poisoning

- Legal fees paid to authorize treatment for mental illness

- Lodging expenses while away from home to receive medical care in a hospital or medical facility

- Long-term care insurance and long-term care expenses

- Mattresses and boards bought specifically to alleviate an arthritic condition

- Medical conference admission costs and travel expenses for a person with a chronic illness to learn about new medical treatments

- Nursing care and nursing home expenses

- Operations (excluding cosmetic surgery)

- Organ transplants

- Oxygen and oxygen equipment to relieve breathing problems

- Physical exams and diagnostic tests

- Pregnancy test kits

- Prescription drugs

- Prosthetic limbs

- Psychiatric care

- Smoking cessation programs

- Special education

- Sterilization or vasectomy

- Telephone and special equipment for a person who is hearing impaired

- Travel and transportation costs for obtaining medical care

- Weight loss programs to treat a specific disease diagnosed by a physician

- Wheelchairs

- X-rays for medical reasons

Long Term Care Premiums or Costs

If you or your spouse requires long-term care, you may be able to deduct the unreimbursed cost for in-home care, assisted living and nursing home services as medical expenses. The long-term care must be medically necessary for a chronically ill person. A person is considered chronically ill when at least two activities of daily living cannot be performed without help for 90 days or more. Anyone in need of long-term care because of dementia or another cognitive impairment is also considered chronically ill if substantial supervision is needed to protect the individual’s health and safety. The chronic illness must be certified by a licensed health care practitioner. The cost of meals and lodging at an assisted living facility or a nursing home also counts if you are there mainly for medical care.

If you purchased a long-term-care insurance policy, a portion of your premium payment qualifies as a medical expense. The deduction is capped based on age. For 2020 returns, the maximum per-person limits are $5,430 for taxpayers 71 or older, $4,350 for taxpayers 61 to 70, $1,630 for individuals who are 51 to 60, $810 for people 41 to 50 and $430 for those 40 and younger. These amounts are a bit higher for 2021: $5,640, $4,520, $1,690, $850 and $450, respectively.

What About Weight Loss Programs?

Weight reduction programs can be considered a medical expense deduction if they are ordered by doctors to treat obesity or hypertension or alleviate another ailment.

Diet foods, weight loss supplements or reduced-calorie beverages, however, are not. A weight reduction plan to improve your appearance doesn’t count either.

Is a service animal deductible?

Veterinary costs for a service dog to assist the visually impaired and others with physical disabilities are eligible medical deductions. The same is true for the cost to buy and train the dog, plus feed and groom it. An emotional support animal also counts if it’s needed primarily to alleviate your mental disability or illness.

Are Gluten Free foods a medical expense if you have been diagnosed celiac?

Yes, you can deduct these expenses as a medical expense deduction if you meet certain requirements.

- You may deduct the cost of gluten-free (GF) food that is in excess of the cost of the gluten containing food that you are replacing. For example, if a loaf of gluten-free bread costs $5.00 and a comparable loaf of gluten containing bread costs $2.50, you may include in your medical expenses the excess cost of $2.50 for each loaf of bread you purchase.

- The full cost of special items needed for a GF diet may be deducted. An example is the cost of xanthan gum used in gluten-free home baked items, which is never used in a gluten containing recipe.

- If you make a special trip to a store to purchase GF foods, the cost of your transportation to and from the store is deductible. For 2021, you may deduct 16 cents per mile traveled. You may also include tolls and parking fees.

- The full cost of postage or other delivery expenses for GF foods made by mail order are deductible.

Step-by-Step Breakdown

Step One: Get an official, written diagnosis from your physician and a prescription for a gluten-free diet. You will need to submit this form with your taxes, so make sure to keep a copy for your records.

Step Two: Save your receipts for your gluten-free groceries.

Step Three: Based on the list above, figure out what you can deduct and then start your calculations! You will need to calculate the difference between gluten-free products and non-gluten-free products from the grocery store.

Step Four: File! Fill out the medical deductions form called the Form 1040, Schedule A.

Please consult your tax preparer when calculating your deductions, and refer to IRS Publication 502.

Medical Education Expense Deductions

“You can include in medical expenses amounts paid for admission and transportation to a medical conference if the medical conference concerns the chronic illness of yourself, your spouse, or your dependent. The costs of the medical conference must be primarily for and necessary to the medical care of you, your spouse, or your dependent. The majority of your time spent at the conference must be spent attending sessions on medical information”

IRS Publication 502

However, you may not deduct the costs for meals and lodging while attending the medical conference.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors prior to acting on any of the information provided here.

Questions? Visit our website to schedule an appointment with one of our Tax Professionals.